Internal Audit VS. External Audit

INTERNAL AUDIT VS. EXTERNAL AUDIT

Internal Audit

What is an audit about?

Learn what you need to know about your company’s financial investigations. We will educate you about the three kinds of audits there are, how to plan for an audit properly, how to impact your business, how to find the right auditor, and more.

What is an Internal audit?

An internal audit is an assessment of the internal controls and accounting procedures of an organization. These audits help ensure that the company is consistent with laws and regulations and help maintain reliable and timely financial data reporting.

In a wide variety of industries, regularly planned internal audits are important. Through them, company owners can easily find out pain points in processes, helping them to recognise possible process issues before they become visible in an external audit. In your business, routine internal audits also provide risk control and protection against possible fraud, waste, or financial abuse.

What is the internal audit process?

First, a department they want to inspect would be defined by management. Next, an independent auditor will try to gather an understanding of the current method of internal control and perform fieldwork research. This is where the department’s actual auditing starts.

Once the assessment has been completed, the auditor will follow up with management on the issues they have found, prepare the official auditor’s report, review the management report, and follow up with management to ensure that the recommendations presented are in effect.

During an internal audit, what happens?

The appointed auditor will observe, take notes, review records and interview staff during an audit. Auditors will also ask questions and assess the awareness of the company’s general priorities, safety policies, training, and rules and regulations for enforcement by staff.

They will briefly handle the results until the auditor is pleased with their investigation. An auditor can express the strengths and deficiencies of the department during a meeting when giving their recommendations. They will also check details for consistency with management and inquire for any conflicts.

After the details are met, the auditor’s report is finalized and expectations for changes to be made are provided to management. To fix any problems, management and the auditor will both agree to a timetable. When all agreed-upon problems are satisfactorily implemented, the audit is formally closed.

Check our professional Internal Audit services from here: Internal Audit Services

How much do they perform internal audits?

Depending on the circumstances and timetable, an internal audit may be carried out on a regular, weekly, monthly, or annual basis that best suits the needs of an organization.

Audits are instruments that management should use to conduct an overall evaluation of their organization and each department within it. In general, internal audits should be carried out regularly enough to find concerns and to avoid enforcement problems.

To allow a department time to prepare documentation and records, internal audits may be planned in advance or they may be a surprise if unethical or illegal activity is suspected.

How to make plans for an internal audit:

1. Prepare an internal strategy for an audit.

An internal audit schedule is a list of all the audit activities and duties that will have to be carried out during the agreed time span. This should be discussed with the auditor, and reviewed by the leadership team. Determining specific measures, processes, and the key focus of the audit is critical.

2. Make your staff ready.

It is good practice to offer departments notice if the audit is regulatory, so that they can have all appropriate financial records and materials ready. Audited agencies may also be interested in the implementation of the required improvements proposed by the auditor, such as new training standards or new training requirements or revisions in compliance policies.

Who is carrying out the internal audit?

An internal auditor who is an employee of the company usually performs internal audits. Internal auditors do not need to be registered public accountants (CPAs), but can receive the certification of a certified internal auditor (CIA), requiring them to comply with accepted requirements regulated by the Institute of Internal Auditors (IIA).

Why is an internal audit being conducted?

The main aim of an internal audit is to analyze and enhance the quality of administration and activities, to provide risk management, and to give your organization more control over essential financial processes.

The areas of concern in a department would be identified by a properly conducted audit and introduced to management in an understandable way. This helps management to make educated choices about how to fix problems in the future and to build the required action plans for discrepancies.

External Audits

What is an external audit?

An analysis undertaken by an independent accountant or accounting firm is an external audit. This kind of audit results in a checked certification of a company’s financial statements. For all publicly owned entities, these approved documents are needed and may be demanded by shareholders, investors, and lenders if there is a perceived inconsistency in the reports.

Independent audits are important in the sense that their approved reports eliminate any prejudice and doubt in the state of a company’s financial position. All external audits carried out in the United States comply with the same requirements as the widely agreed auditing standards (GAAS) set by the Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA).

What is an external audit process?

An external audit begins with either an impartial auditor’s appointment or recruiting. This means hiring someone who will be audited external to the company. In general, at the Annual General Meeting, shareholders may nominate an auditor.

Next, there will continue to be external auditing. In order to obtain complete knowledge of all the activities of the organization, the auditor may collect, review and analyze data. This involves checking the accounting reports of the company, looking at financial statements in order to obtain proof, verifying compliance with standard accounting practices, and confirming the purchased assets.

The auditor will submit their report and state their objective opinion once they feel their investigation is satisfactory. The findings of an external audit and the opinion of the auditor can seriously influence a company’s reputation and future. The opinion and rating of an auditor can mean whether a company stays in business or not.

Check our External Audit Service from here: External Audit Services

During an external audit, what happens?

An auditor will thoroughly review your financial and performance records during an external audit. This includes checking whether these records are accurate and complete, whether these records have been prepared in accordance with generally accepted principles, and whether your financial statements represent the financial position of your company correctly.

The process of the auditor involves going through the records used to generate each financial statement and re-creating them to see whether they were correctly created. In order to try to identify differences and irregularities that might be a sign of incorrect financial reporting, they will also compare your business to others in the same industry.

The auditor will prepare and deliver an auditor’s report to your business at the end of the external audit, including the audit details and findings. This will include the discrepancies identified in the financial reporting and any non-compliance with your company’s relevant rules and regulations.

How frequently are external audits carried out?

A business will generally not have more than one external audit per year.

Because of the provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934, publicly held companies are legally required to conduct annual external audits. The results of this audit must be submitted to a party related to the government.

At the random request of an entity, an external audit also takes place to confirm that the accounting records follow standard practices. For example, an external audit may occur when a part of a company’s financial statements is questioned by a government entity. Some instances where an audit may be ordered are when tax fraud is detected by the IRS, when shareholders feel that the company does not produce GAAP-compliant financial statements, or when illegal activities are suspected by the court due to the spending of business funds.

Who is carrying out an external audit?

An external audit is carried out by an external auditor working for an independent accounting company. Generally, a Certified Public Accountant (CPA) must be an external auditor and must follow the U.S. Auditing Standards Generally Accepted (GAAS).

How to prepare for an external audit:

1. Make your team ready.

It is wise to designate a “audit liaison” or “audit manager” within your team in preparation for your audit, who will act as the main contact for the auditor. This will run smoothly through the audit process and prevent miscommunications between the team and the auditor. They should be referred to the audit manager whenever the auditor has a question or request. A wise choice is an experienced team member who has very strong project management and communication skills when picking an audit manager.

2. Get your records ready.

You should expect to receive applications from the auditor for additional information and documents during the audit process. These may range from proof supporting a particular transaction, such as receipts, to more thorough descriptions of the process and controls of your company. Keeping a detailed list of all records you provide to the auditor during the process is wise and keeping track if any of your records are taken off-site.

Why is an external audit being carried out?

The key objective of an external audit is to verify the financial statements of a corporation and to ensure the integrity of the financial results. The findings of an external audit verify that the company’s financials are right and safe for third parties.

While external audits are often necessary, due to the importance of a checked auditor’s report, some organizations find it useful to conduct them voluntarily. If a small business or nonprofit applies for grants, it may be helpful to provide checked and reliable financial statements. For certain contract bids or grant requests, audit reports may also be a prerequisite. Several businesses also find that conducting an external audit is a way to help build public confidence in their company.

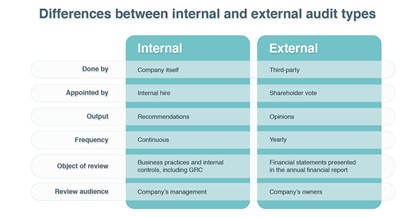

Internal Audit vs External Audit

You Can find all our Accounts below:

Company Accounts:

LinkedIn: https://www.linkedin.com/company/13288994

Facebook: https://www.facebook.com/wallstreetconsultancy/

Twitter: https://twitter.com/Wallstreetuae

Instagram: https://www.instagram.com/wall_street_consultancy/

Quora: https://www.quora.com/profile/Muaiad-Al-Hariri-CPA

Pinterest: https://www.pinterest.com/MuaiadMAlhariri/_created/

Tumblr: Tumblr

YouTube: https://www.youtube.com/channel/UC_TbhAcktrIFAI_j5-6DElg?view_as=subscriber?sub_confirmation=1

Telegram Channel: https://t.me/Finance369

Udemy Latest Course: https://www.udemy.com/course/reading-financial-statement/?referralCode=44D4DFCEFFCA76BF3D5A