Financial Statements … What you need to know

Introduction:

Financial Statements:

Financial Statements contains from 5 financial statement. The primary goal of financial accounting is the preparation of financial reports.

For the purpose of clarifying the financial position and profitability of the company on a specific date and providing useful financial information to the users , whether inside or outside the establishment.

the establishment represent a structural presentation of the financial nature of its financial position and the transactions it has completed.

Generally, financial statements aim to provide information about the financial position, activity results and cash flows that benefit a wide range of users in decision-making and help to show the results of the administration’s use of the available resources.

To achieve this objective, the financial statements provide data on the following:

- Assets,

- Liabilities,

- Equity,

- Revenues and expenses including profits and losses,

- Other changes in equity and

- Cash Flow.

This information – in addition to other information contained in the notes supplementing the financial statements – helps the users of the financial statements in forecasting the future cash flows of the establishment, especially the timing and likelihood of generating these cash flows.

To achieve this goal, the International Accounting Standard No. 1 “Presentation of Financial Statements“ defined the general considerations for presenting the financial statements and provided an explanation of their structure and the minimum components of the required financial statements. And the income statement, as well as in the presentation of the statement of changes in equity.

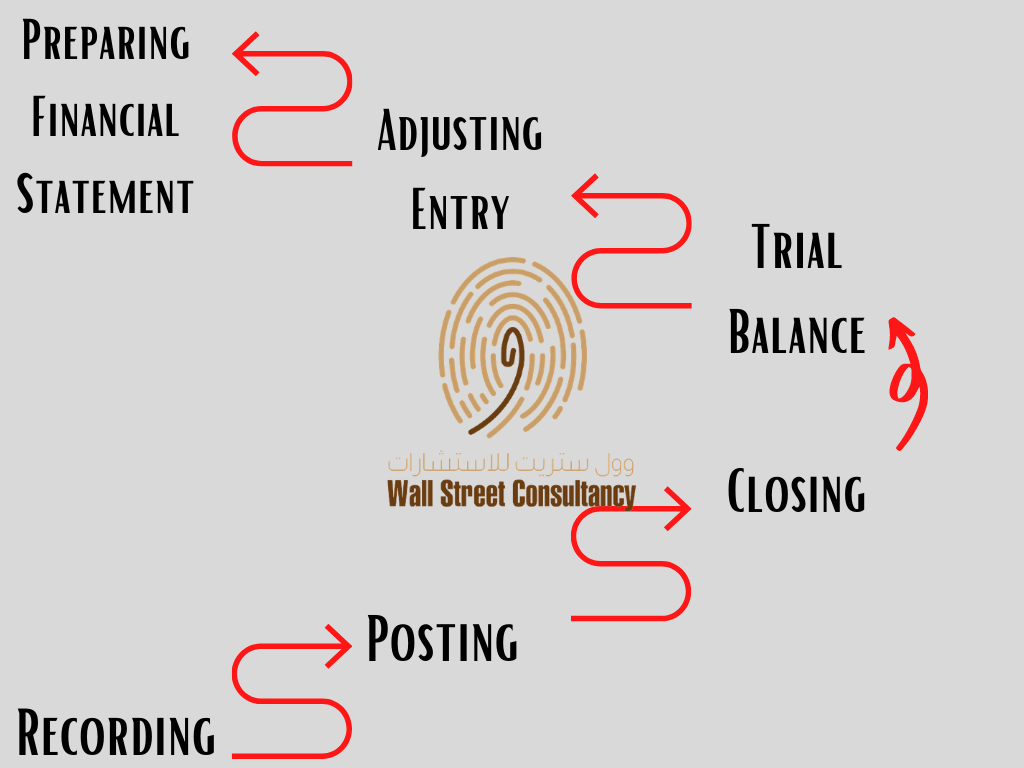

Read about the auditing process step by step

So that the integrated financial statements must include the following components:

- Balance Sheet

- Income Statement

- Changes in Equity Statement.

- Cash Flow Statement.

- Supplementary Notes, including a summary of the most important accounting policies and any other explanatory notes.